You're in the right place for expert financial advice

Getting started is easy, fast and free.

expert fiduciary advisor match

Find the expert advisor with our NO COST 3-minute retirement quiz.

Why ExpertAdvisorMatch?

Fast

Get matched and book a meeting in minutes.

Secure Process

Your details are only shared with your single trusted financial advisor.

Free

Matching with an advisor is completely free.

The best time to have a plan was Yesterday.

The second best time is Today.

Concerned about retirement finances? A retirement specialist can help you create a personalized strategy, avoid mistakes, and maximize your savings for long-term growth after retirement. Prepare for your future through thoughtful, tailored planning.

Access to

Investing

Tax Strategies

Financial Planning

Retirement Planning

Estate Planning

Tons of

Happy Clients

You're in good hands

Let's match you with a fiduciary financial expert.

Verified

We verify that all financial advisors are registered with the Securities and Exchange Commission (SEC) or state securities regulators. They must also confirm whether they are fiduciaries or broker-dealers. Mortgage advisors are verified with their firm and checked against the Nationwide Mortgage Licensing System (NMLS) registry.

Here's how we Help you

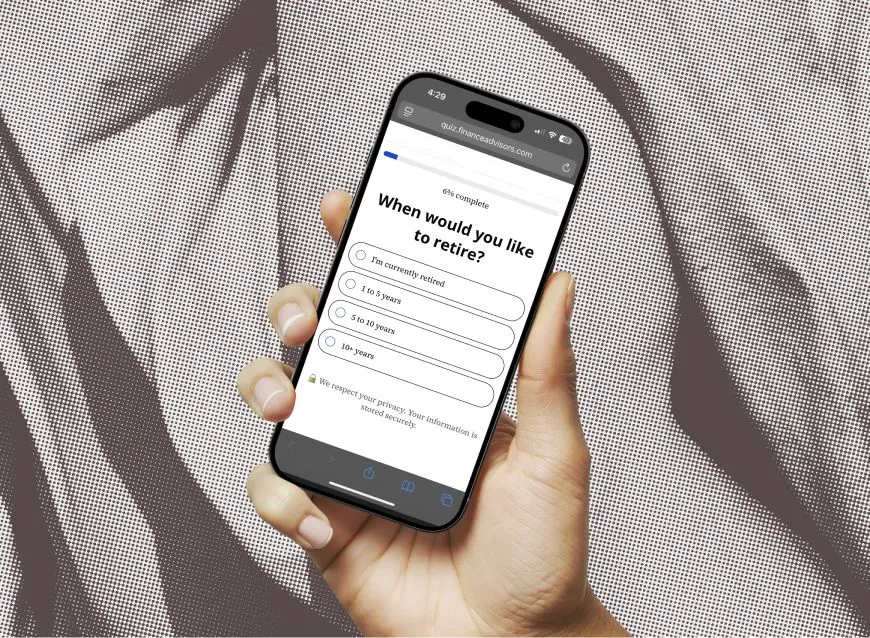

1. Take a simple quiz

Let us know a bit about you and your goals to get matched with an advisor suited to your needs.

2. Connect with Your Private Advisor

We’ll get you matched immediately or set up a time that works best for you and your advisor.

3. Get Personalized Advice

Walk away from your consultation with actionable steps to help you take actionable next steps toward your financial goals.

Frequently Asked Questions

Q: What does a financial advisor cost?

Financial advisors may charge a flat fee, a percentage of assets under management (AUM), hourly billing, or commissions. Make sure you understand how your advisor gets paid and what your total costs will be.

Q: What qualifications should I look for in a financial advisor?

Look for credentials like CFP® (Certified Financial Planner) or CFA® (Chartered Financial Analyst). Also ask how long they've been practicing and whether they’ve worked with clients in similar financial situations.

Q: What services to financial advisors offer?

Advisors may provide investment management, retirement planning, tax strategies, estate planning, insurance advice, and budgeting. Be sure their services align with your goals.

Q: How do financial advisors invest my money?

Advisors use different investment strategies. Ask about their approach to risk, diversification, and how they tailor investment plans based on your objectives and time horizon.

Q: Are financial advisors required to act in my best interest?

Only fiduciary advisors are legally required to act in your best interest. Be sure to ask if the advisor operates under a fiduciary standard.

Q: How often will I hear from my advisor?

Communication frequency varies. Some advisors meet quarterly, others annually. Confirm how often you’ll receive updates and how they prefer to communicate—phone, video, or in person.

Q: What is an Investment Policy Statement (IPS)?

An IPS is a written plan that outlines your investment goals, strategy, and rules for monitoring progress. It helps ensure long-term alignment between you and your advisor.

Q: How many clients do you work with?

This gives insight into the advisor’s availability and ability to provide personalized attention. Fewer clients often means more direct access.

Q: Do you specialize in clients like me?

Advisors often focus on specific groups—such as retirees, business owners, or high earners. Look for someone experienced in handling situations similar to yours.

Q: What makes a financial advisor worth the cost?

Financial advisors can provide help in navigating the complex world of modern investing.

A recent Vanguard study found that, on average, a hypothetical $500K investment would grow to over $3.4 million under the care of an advisor over 25 years, whereas the expected value from self-management would be $1.69 million, or 50% less. In other words, an advisor-managed portfolio would average 8% annualized growth over a 25-year period, compared to 5% from a self-managed portfolio.

Assuming 5% annualized growth of $500k portfolio vs 8% annualized growth of advisor managed portfolio over 25 years. Source: Vanguard Research

Q: Who are the top 5 financial advisor firms in the US?

Based on the methodology below, these financial advisor firms are among the top 5 financial advisor firms in the U.S.

1: Fisher Investments

2: Captrust

3: Wealth Enhancement Group

4: Mesirow

5: Summit Rock Advisors

Methodology

From among all firms registered with the SEC in the country, that offer financial planning services, primarily serve individual clients, and those that do not have disclosures on their record. The qualifying firms were ranked according to the following criteria:

AUM: Firms with more total assets under management are ranked higher.

Individual Client Count: Firms that serve more individual clients (as opposed to institutional clients) are ranked higher.

Clients Per Advisor: Firms with a lower ratio of clients per financial advisor are ranked higher.

Years In Business: Firms that have been in business longer are ranked higher.

Fee Structure: Firms with a fee-only (as opposed to fee-based) compensation structure are ranked higher.

These stats are updated as of June 17, 2021.

Q: Is there a minimum investment requirement to work with an advisor?

The minimum investment can vary by advisor or firm. In order for you to be appropriately matched, please complete the quiz as accurately as you can.

Q: Do finance advisors provide investment advice?

Finance Advisors does not provide investment advice. We partner with a network of licensed & vetted advisors.

You’re In A Powerful

Position To Improve

The Rest Of Your Life.

Let’s Talk.

ExpertAdvisorMatch

Service

Contact

© Copyright 2026. ExpertAdvisorMatch. All Rights Reserved.